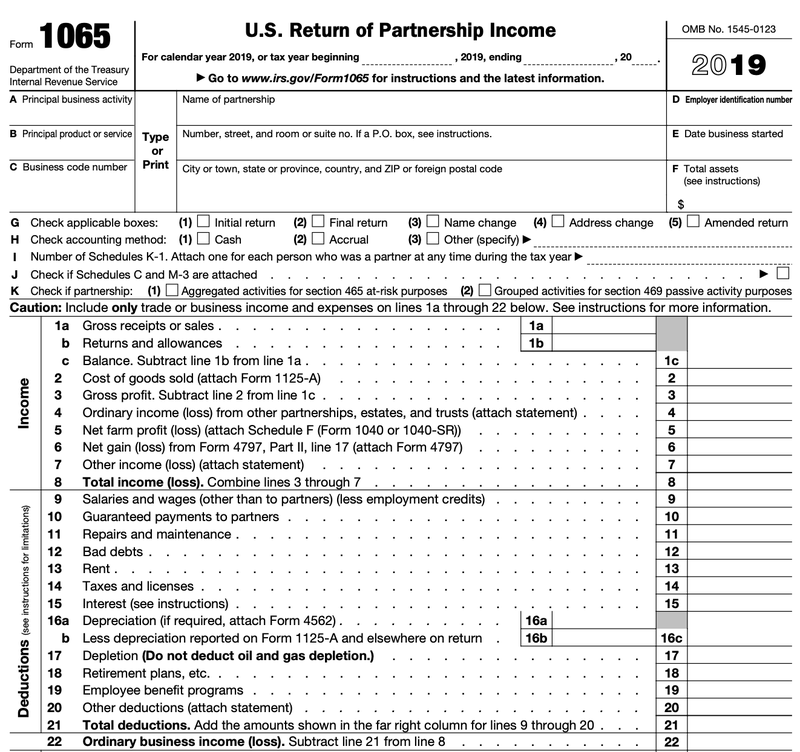

The withholding tax liability of the partnership for its tax year is reported on Form 8804.

What forms does the partnership file to report the tax? In the case of a partner certification, the partnership is not required to withhold and pay a withholding tax with respect to the foreign partner if the partnership estimates that the annualized or actual tax due is less than $1,000. In addition, a nonresident alien partner can also certify to the partnership that the partnership investment is (and will be) the only activity of the partner for the partner’s taxable year that gives rise to effectively connected income, gain, loss or deduction. The IRS allows foreign partners to certify to the partnership certain deductions and losses that will be applicable to the current year. However, the rate is 35% for corporate foreign partners. The withholding rate that is applicable for effectively connected income allocable to non-corporate foreign partners is 39.6%.

The goal of course is to ensure that the IRS collects tax from nonresident aliens in case they fail to file a tax return and, accordingly, pay any tax that is due. This withholding tax requirement does not apply to income that is not effectively connected with the partnership’s U.S. Revenue Procedure 92-66 and Treasury Regulation section 1.1446-3 establish the timing and reporting requirements of the withholding tax. This withholding is required under IRC section 1446. trade or business, it is required to withhold on the income that is allocated to its foreign partners. If a partnership (including an LLC filing as a partnership) has income that is effectively connected with a U.S.

What is a partnership withholding on foreign partners and why is it required? Partnership Withholding on Foreign Partners Let’s take a closer look at the requirements. This is a very misunderstood area of the law and can sometimes be difficult to explain to clients, especially since they reside overseas. I have discussed FIRPTA and NRA withholdings in previous articles, so the goal of this article is to discuss the partnership withholding requirements.

0 kommentar(er)

0 kommentar(er)